Cryptocurrency – Digital Currency, Current Rate

The internet, when it rose to global consciousness and became an overwhelming harbinger of disruption across society, economies and industry, created enormous wealth and value in disrupting existing practices and building cheaper, more accurate and efficient systems. Its advent promised much in terms of decentralizing and democratizing access to information, value and services. It promised to remove barriers and middlemen, vastly reduce operational and logistical costs in so many ways. And it has, to an extent, that the average human being can’t not be exposed to the internet multiple times every waking (and sleeping) day.

The latest disruption, blockchain, and with it, the rise of cryptocurrencies show the way to the next stage, by creating decentralized computer networks capable of holding value, contracts, agreements, transactions in an encrypted manner. By truly decentralizing the network that creates this value, it removes a dependency on any one authority or institution to reduce, remove or change the value of any such holding. And the first initiative off the table with the rise of blockchain computing would be Bitcoin, a digital currency or cryptocurrency.(Learn how you can trade bitcoin with reliable trading bots like Bitcoin Loophole)

The creator of bitcoin is Satoshi Nakamoto. The name is a pseudonym — no one knows who she or he actually is. Besides being the creator, Nakamoto holds enough bitcoin to flood the market, crashing its value and rendering it worthless. In addition, the founder can also influence any debate on future directions of Bitcoin, thereby holding huge potential implication for the future of crytocurrencies as a whole.

Bitcoin is but just one cryptocurrency. It is the leading one, however, with a total market value of USD 231 billion as of publishing time, accounting for 36% of the total value of all cryptocurrencies. The entire crypto currency market hit its peak value at about USD 700 billion in January 2018. Ethereum (13% market share) and Bitcoin cash (8%) are just two other major cryptocurrencies that are being traded today.

Satoshi Nakamoto: speculation on true identity

Table of Contents

The mystery surrounding the identity of Bitcoin creator Satoshi Nakamoto continues to cause intrigue. But nobody, not even his closest collaborators, has ever met Mr Nakamato in person. Although s/he not only wrote the white paper, but also the first version of the software powering the system, s/he eventually stopped participating. “I have moved on to other things,” s/he wrote in April 2011.

# In March 2014, a US magazine Newsweek, identified Dorian Satoshi Nakamoto, a man living in California, as the real Satoshi, but this turned out to be an embarrassing mistake. He lived near another possible suspect Hal Finney.

# Computer scientist Hal Finney, who was the recipient of the first Bitcoin transaction, is also sometime speculated to be the creator of Bitcoin. Finney was an early employee of cryptography company PGP and also knows “decentralised currency enthusiast” and scientist Nick Szabo who penned a paper on “bit gold” way back in 1998 and was said to be a fan of pseudonyms. Szabo seems to have asserted in 2011 that only he, Finney or Wei Dai – creator of Bitcoin precursor B-Money – could have been responsible for Bitcoin.

# Craig Wright, an Australian businessman and computer scientist, had in May 2016 posted online what he claimed to be proof that he is Satoshi Nakamoto. That was supported by Gavin Andresen, Mr Nakamoto’s successor as the lead developer of the bitcoin software; however, the claim was widely seem to have been debunked as fake.

# In November 2017, a blog post by former SpaceX employee claimed that Elon Musk was Satoshi Nakamoto, given his fondness for C++, known skill with cryptography, linguistic habits that seem close to Nakamoto’s and general all-round billionaire polymath-who-likes-to-solve-big-problems status; Musk himself has denied it.

Proof of Work

Proof of work is perhaps the strongest idea behind Nakamoto’s Bitcoin white paper because it allows trustless and distributed consensus. The Proof of work concept existed even before bitcoin, but Satoshi Nakamoto applied this technique to digital currency revolutionizing the way traditional transactions are set.

A trustless and distributed consensus system means that if you want to send and/or receive money from someone you don’t need to trust in third-party services. Proof of work is a requirement to define an expensive computer calculation, also called mining, that needs to be performed in order to create a new group of trustless transactions (the so-called block) on a distributed ledger called blockchain. All the network’s miners compete to be the first to find a solution for the mathematical problem that concerns the candidate block, a problem that cannot be solved in other ways than through brute force, essentially requiring a huge number of attempts. When a miner finally finds the right solution, he/she announces it to the whole network at the same time, receiving a cryptocurrency prize (the reward) provided by the protocol.

In this system the probability of mining a block is dependent on how much work is done by the miner. Originally published by Cynthia Dwork and Moni Naor back in 1993 as an idea, the term “proof of work” was coined by Markus Jakobsson and Ari Juels in a document published in 1999.

Bitcoin Use

Bitcoin gives anonymity to transactions if used correctly. This has made it useful for many illicit transactions. But there are many mainstream businesses beginning to accept Bitcoin as well.

# Overstock.com, a large online retailer in US, was the first big online retailer to start accepting Bitcoin in January of 2014. The company allows its customers to pay for laptops, television sets, furniture, etc. with Bitcoin. It also supports other major cryptocurrencies, including Ethereum, Litecoin, and the new Bitcoin Cash through Coinbase partnership.

# Newegg, an online electronics retailer, accepts Bitcoin as a payment method.

# Expedia, a travel site, started accepting Bitcoin for payments for hotel bookings in 2014 through tie up with Coinbase.

# Subway franchises in Buenos Aires, Argentina in 2017 started accepting Bitcoin for payments at the restaurants.

# Microsoft has started accepting originally published by Cynthia Dwork and Moni Naor back in 1993 originally published by Cynthia Dwork and Moni Naor back in 1993Bitcoin from users to purchase games, movies and apps in the Windows and Xbox stores, as well as the Microsoft online stores.

# Bitcoin can also be used to pay for space travel as since 2013, Virgin Galactic, a commercial space flight venture by Sir Richard Branson, accepts purchases using Bitcoin.

# The now closed Silk Road website, an online black market, was almost the eBay or Amazon of drugs. Bitcoin was the payment method for transaction. It famously ran as a Tor hidden service and used masked address to help keep users anonymous. But Silk Road was shut down in October 2013 after FBI investigations busted Ross Ulbricht as alleged founder. FBI may be rueing the day it sold its hoard of Silk Road Bitcoin for $48 million as those coins are now worth an astonishing $2+ billion.

# There are other dark markets that do trade in illicit goods using Bitcoin. These include Silk Road 2.0, Agora, White Rabbit Anonymous Marketplace, Outlaw Market and The Pirate Market. Many have been and continue to be taken down by government agencies where possible.

# Wannacry, a ransomware that affected 200,000+ computers globally in 2017, asked for the equivalent of $300 in Bitcoin to unlock their victim’s machines; the attackers were able to collect the equivalent of ~$55,000 (at Bitcoin rates of ~USD 1500).

# Drug dealers have been suspected to be using cryptocurrency ATMs in London to stash the proceeds of their crimes, London’s Metropolitan Police has said. There are around 50 Bitcoin ATMs in London which allow swapping of cash directly for cryptocurrencies without alerting law enforcement in the way a large cash deposit at a bank might.

Top Cryptocurrencies & their Values

(As of Dec 15, 2017)

Bitcoin ATMs

There are globally 1900+ Bitcoin ATMs, of which 30% or so also support other cryptocurrencies. A Bitcoin A.T.M. accepts a normal currency (e.g. US dollars) and in return adds the bitcoin equivalent (less any transaction charges) to a customer’s digital wallet. So, a user will need to have a Bitcoin Wallet where this amount is transferred. Since verification standards are less stringent than online exchanges, the law enforcement agencies have raised the prospect of money laundering via such Bitcoin ATMs.

Bitcoin ATM manufacturers include Genesis Coin, General Bytes, Lamassu, Coinsource and others. North America accounts for 75% of these ATMs (1000+ in US alone) with Europe having ~20% and Asia another 2%.

Bitcoin Wallets

Bitcoin wallets store the private keys that one needs to access a bitcoin address and spend the funds. They store the secure digital keys used to access the owner’s public bitcoin addresses and sign transactions. These wallets can be software based (desktop, mobile, web) or even be on specialized hardware.

Desktop wallets include those that run on Windows, Linux or OSX and include the original Bitcoin Core as well as others like ArcBit, Electrum, Armory, et al. Mobile based wallets overlap with those for desktop (e.g. Bitcoin Core, ArcBit, Electrum). Some of these mobile wallets offer the advantage of enabling payment for transactions at vendors accepting Bitcoin. Coinbase, an integrated wallet/bitcoin exchange is one of the more popular operators of an online wallet worldwide. All these can be categorized as Hot Wallets. Because hot wallets generate the private keys on an internet connected device, these private keys can’t be considered 100% secure. Cyber-criminals could, potentially, target your computer’s “software wallet” and steal them by accessing the owner’s private key.

Generating and storing private keys offline using a hardware wallet, also dubbed cold wallets, ensures that hackers have no way to reach the stored Bitcoin. Since these are not free, unlike software wallets, these may only make sense to store sizable amounts of Bitcoin. The all-important private keys are maintained in a secure offline environment on the hardware wallet, mostly protected even should the device be plugged into a malware-infected computer. Some of these have screens which can provide extra security by verifying and displaying important wallet details. Hackers would have to steal the hardware wallet itself, but even then, it can be protected with a PIN code. The major hardware wallets include KeepKey, Ledger Nano S, Trezor & Digital Bitbox.

Another popular and cheap options for keeping Bitcoin safe is something called a paper wallet. There are several sites offering paper bitcoin wallet services. They will generate a bitcoin address for and create an image containing two QR codes: one is the public address that can be used to receive Bitcoin; the other is the private key, which can be used to spend Bitcoin stored at that address.

Bitcoin Forks

On August 1st 2017, a dissident faction of the Bitcoin community created a new payment network called Bitcoin Cash, which branched off from the existing Bitcoin blockchain. One could almost call it analogous to a stock split: each holder of Bitcoin on this date also got a certain amount of Bitcoin Cash. Bitcoin cash is now the 3rd most valuable cryptocurrency. All this created value almost out of thin air i.e. the USD value of Bitcoin plus Bitcoin Cash was higher than what it was of Bitcoin just before the fork.

A fork is created when there are tweaks to the established formula governing the blockchain underlying a cryptocurrency. Bitcoin Cash increases the size of an individual block by eight times compared to Bitcoin blockchain, which allows for faster transactions. Bitcoin Gold uses an algorithm that discourages the use of specialized mining hardware in an effort to make the currency more egalitarian.

Calling a fork after Bitcoin gives it instant name recognition and also creates a group of stakeholders i.e. existing Bitcoin holders who may seek legitimacy, liquidity and support for new currency as they automatically become owners of the new currency. They may in turn arm twist exchanges and if a bunch of exchanges announce support for a new currency—or at least the ability to withdraw balances—that amounts to a de facto endorsement of the currency. And if an exchange does the work to allow customers to withdraw a Bitcoin variant, they might go all the way to supporting it for deposits and trading, too.

Although Bitcoin Cash and Bitcoin Gold have dominated the news around forks in 2017, Litecoin was one of the earliest Bitcoin forks to be successful. Ethereum has also undergone almost five forks since inception, including a fork nicknamed Byzantium in 2017 and another that created Ethereum Classic in 2016. It remains to be seen which forks create value going forward.

Bitcoin Richlist

# Cameron and Tyler Winklevoss bought approx. 1% of all currently mined bitcoin for merely $11 million in 2013. Since then, the $11 million crypto-bet has returned ~10,000%, making the twins the first bitcoin billionaires. The twin brothers had sued Mark Zuckerberg, claiming he stole the concept for Facebook and had got USD 65 Million in settlement

# Venture capitalists, Barry Silbert and Tim Draper got 48,000 and 30,000 Bitcoin respectively in an auction held by the U.S. Marshals Service in 2014, which the government had seized from Silk Road, an online marketplace it said was used for illegal drugs. Bitcoin was around USD 350 at that point.

# There are 2,422 accounts publicly known to have USD 10 million worth of Bitcoin in each of them as per bitinfocharts.com.

Going Forward

The energy being spent on mining Bitcoin and other cryptocurrencies has become a controversial issue. To address that, Bitcoin’s competitor, Ethereum is looking to move also migrating towards what is called Proof of Stake with its new “Casper” protocol. The plan effectively means ethereum will begin alternating between the two systems, so that some transaction blocks (one out of 100) are secured via proof-of-stake and the rest remain on proof-of-work.

In proof-of-stake, participants similarly commit money to the system, but not with electricity and equipment. With Casper (Ethereum), virtual miners, known as Validators, commit money to the system with the understanding that they will lose their deposits if they don’t follow the rules.

In general, a proof of stake algorithm looks as follows. The blockchain keeps track of a set of validators, and anyone who holds the blockchain’s base cryptocurrency (ether in Ethereum’s case) can become a validator by sending a special type of transaction that locks up their ether into a deposit. The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate in.

There are many kinds of consensus algorithms, and many ways to assign rewards to validators who participate in the consensus algorithm, so there are many “flavors” of proof of stake. One is the chain-based proof of stake, where an algorithm pseudo-randomly selects a Validator during each time slot (eg. every period of 10 seconds might be a time slot), and assigns that validator the right to create a single block, and this block must point to some previous block (normally the block at the end of the previously longest chain), and so over time most blocks converge into a single constantly growing chain.

This allows building a trusted and distributed network with loyal Validators (high stake of coins). The Validators earns the part or whole of the transaction fee. In Proof of Stake, it is not “mining” but “forging” which is done by the Validator who will process and forge a block to the chain. In this case, the need for expensive mining hardware and the concurrent electricity consumption issues of Proof of Work are addressed.

Ethereum

Ether, Bitcoin’s largest competitor, began from an altogether more transparent initiative compared to the mystery surrounding Nakamoto. The project Ethereum was initially bootstrapped funded by fans and founded under the Ethereum Project, a Swiss non-profit organization.

Ethereum underwent a hard fork in mid-2016 owing to the DAO event. The DAO was a digital decentralized autonomous organization, and a form of investor-directed venture capital fund. It raised a record $150 million in investment via crowdfunding in May. However, in June, users exploited a vulnerability in the DAO code to siphon off a third of its funds to a subsidiary account. The debate over restoring all the funds to the original contract virtually led to a hard-fork, giving birth to Ethereum Classic (the original unforked blockchain) and Ethereum (the new fork), each with its own cryptocurrency.

Ethereum has since undergone two more hard forks in the 4th quarter of 2016 to deal with more attacks. It subsequently increased its protection and security and eliminated several vulnerabilities.

As of today, Ether accounts for 13% of the total market value of digital currencies traded. As the second most popular cryptocurrency available, and an influential decentralized community behind its rise, it bears watching as a trendsetter of the cryptocurrency ecosystem and will play a large role in its acceptance worldwide.

In addition to Ether, blockchains in general and to a larger extent, Ethereum larger capabilities to transfer value between participants via means other than Ether and Bitcoin.

Smart Contracts

Smart contracts help participants exchange money, property, shares or anything of value by translating contracts into code and executing that code in line with the terms of the agreement, supervised by the network that runs the blockchain. By this means, contracts can be effortlessly delivered and executed with all terms built into the code and with equal visibility provided to all participants. That way, any changes made to such agreements need to be validated by all participants. Smart contracts define and enforce the rules, conditions and positions built into the agreement.

For example, if a tenant seeks to rent a house from the owner, the tenant can do this via blockchain py paying in cryptocurrency. A receipt is given to him/her, which is held in the virtual contract. The owner then gives the digital entry key to the tenant by the specified date, basis which the money is then released to the owner. This entire transaction is witnessed by hundreds of people, due to which the delivery is faultless.

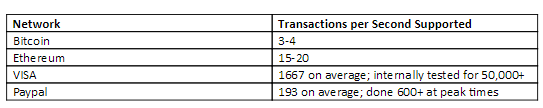

Transaction Volume Support

Bitcoin and Ethereum today can support only a fraction of transactions per second that is supported by VISA, Paypal, etc. This limits their use as method of transaction for purchase of goods and services. While there are ongoing projects that are looking to scale up the number of supported transactions, e.g. Raiden for Ethereum, it will remain to be seen how liquid these enhancements make and over what time frame.

Can Bitcoin Blockchain security be compromised?

The strength of Bitcoin and other cryptocurrencies is its distributed ledger. It means there is no one central authority controlling the network. Transactions, etc. are validated through consensus. But in theory, what could go wrong? If a group of miners form a cartel and controls more than 50% of the computational power on the network, it can always mine blocks faster than whoever has the other 49 percent. In that case, it effectively controls the ledger.

If such a cartel is malicious, it can spend Bitcoin twice, by deleting transactions so they are never incorporated into the blockchain. The other 49% of miners are none the wiser because they have no oversight of the mining process.

Bitcoin and Quantum Computers

Quantum computers are a different type of computer than any of our current machines. It uses quantum superposition to speed up many of the processes that would take years in conventional computers e.g. factoring large prime numbers. Prime number factoring difficulty is an underlying assumption for most public key encryption systems today and even Bitcoin in a way.

Bitcoin has a cryptographic security feature to ensure that only the owner of a Bitcoin can spend it. The idea is that the owner generates two numbers—a private key that is secret and a public key that is published. The public key can be easily generated from the private key, but not vice versa. A signature can be used to verify that the owner holds the private key, without revealing the private key, using a technique known as an elliptic curve signature scheme. In this way, the receiver can verify that the owner possesses the private key and therefore has the right to spend the Bitcoin.

The only way to cheat this system is to calculate the private key using the public key, which is extremely hard with conventional computers. But with a quantum computer, it is easy. And that’s how quantum computers pose a significant risk to Bitcoin. As per recent research papers, the elliptic curve signature scheme used by Bitcoin is much more at risk, and could be completely broken by a quantum computer as early as 2027.

Indeed, quantum computers pose a similar risk to all encryption schemes that use a similar technology, which includes many common forms of encryption. There are public-key schemes that are resistant to attack by quantum computers. So it is conceivable that the Bitcoin protocols could be revised to make the system safer. But there are no plans to do that now.

Public and Regulator Acceptance

So far, regulatory and government authorities have struggled to keep up with the pace of development in this space. The Winklevoss Bitcoin Trust was an initiative to launch a publicly-traded ETF, filed in 2013 and rejected by the Securities and Exchange Commission in March 2017. The SEC rejected it on several grounds, from claiming that digital currencies needing to mature more as a tradeable asset to the lack of safeguards in the markets to prevent fraud and manipulation. The Winklevoss Bitcoin Trust would have offered investors the chance to acquire and trade shares based on a basket made up entirely of bitcoin holdings.

European governments are worried about a different aspect entirely. There is a growing worry that money-launderers, drug traffickers and terrorists are using the world’s most popular digital currency. And governments within and without the European Union are driving this push, with France, Italy and even the UK seeking to regulate it.

Two Nobel laureates, Joseph Stiglitz and Robert J. Shiller have denounced it in the last month alone, claiming it should be outlawed, doesn’t serve any social purpose and that “digital currencies were being driven by a narrative akin to a mystery movie that draws in people who wish to outsmart the system”. Garrick Hileman, a research fellow at the University of Cambridge’s Judge Business School, has this to say, “What’s happening right now has nothing to do with Bitcoin’s functionality as a currency – this is pure mania that’s taken hold.”

Besides the above, there has been some movement for other initiatives in this space:

# Coinbase launched the first regulated bitcoin exchange in the U.S.

# Winklevoss brothers’ bitcoin exchange, Gemini has been granted a license by the NY Department of Financial Services

# The European Court of Justice has ruled that exchanging bitcoin should be exempt from Value-Added Tax, similar to how any traditional currency is treated.

# As detailed elsewhere here, several businesses have started accepting bitcoin as a means of payment as well from Microsoft to Expedia and businesses running on the dark web such as Silk Road 2.0.

India Crypto’ed?

As a fast moving space, and with the amount of capital flowing into Bitcoin, Indian and international governments and regulatory agencies have been cognizant of the potential and threat this poses to traditional monetary flows and the banking system as it exists today. This is above and beyond the potential rise of blockchain as a disruptor of the BFSI industry as we know it today.

A recent survey conducted by the Income Tax Department on major crypto exchanges in India seems to be leading to notices being issued to about 500,000 high net worth individuals trading on Bitcoin in India. This is happening at a time when there is still no regulatory clarity and oversight on cryptocurrencies and Bitcoin exchanges in India.

In the three notifications that the RBI has issued so far on Bitcoin, it has chosen to take a cautionary stance advising the public on the risks of these currencies and the lack of authorization and licensing in this space so far in India.

After repeated circulars from the RBI, the government finally set up an inter-disciplinary committee to examine the existing framework of existing currencies. As of the time of publishing, Arun Jaitley, Finance Minister reiterated the government’s current stance on cryptocurrencies in the 2018 Winter Parliament i.e. that they cannot be considered as legal tender and the government will make its decision once the committee submits its findings.

There is currently ongoing a debate on how cryptocurrencies are to be treated, whether as a currency (given its widespread adoption as an instrument of transaction) or as a trading asset (to be regulated by applicable frameworks, from investor risk to value creation and potential for anti-trust). The nature of blockchain makes it a unique entity, one which will struggle to fit into the policy prevalent today.

In the midst of all this, several platforms have come up in India and other markets offering retail investors quick and easy means to invest in Bitcoin. With the lack of regulation on investing and taxation into digital currencies, these platforms are dependent on the constantly changing legal and taxation guidelines concerning Bitcoin.

Zebpay, one of India’s leading platforms for investing in cryptocurrencies, hit USD 2 million in revenue in FY 2017 and claims to process trading volumes worth INR 70 cr+ everyday; adding over 2 lakh new users every month.

Initial Coin Offerings

Another means to create value in the cryptocurrency space is to participate in an ICO. Initial Coin Offerings are a means to raise funds for new cryptocurrency ventures or start-ups. Where in an IPO, stakes in the venture are sold to investors in exchange for legal tender, in an ICO, digital tokens, or coins are sold to backers in exchange for legal tender, or other cryptocurrencies (usually Ethereum or Bitcoin). However, in an ICO, this exchange is largely publicly driven, similar to a crowdfunding campaign (but with actual exchange of stakes/equity of sorts and not a donation).

The Securities and Exchange Commission (USA) announced its intention to treat coins as securities which are subject to agency regulation. In December 2017, it shut down an ICO initiative by the name of Munchee, which was seeking to raise USD 15 million in capital to enter the restaurant review space. It raised about 200 ether before closing as per the SEC’s update. However, the technicality cited was that Munchee should have registered with the SEC before raising capital, which it did not. This lack of clarity is a valid concern for the general public looking to participate or invest in this space.

Beyond the risk, ICOs offer a means for greater participation in the blockchain surge. Ventures seeking to raise capital via cryp